city of mobile al sales tax application

The sales tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. 15 penalty will be assessed beginning February 1st through February 28th.

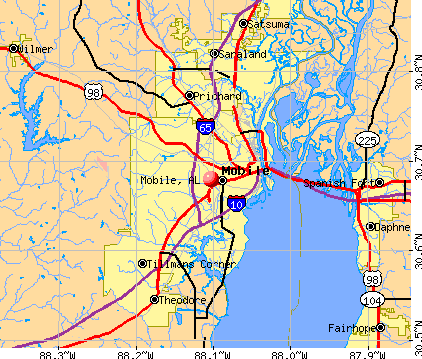

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Food Beverage Tax Form 7.

. Online Filing Using ONE SPOT-MAT. Mobile AL 36652-3065 Office. Sales tax form 12 pdf file seller use tax tax form 13 pdf file business license application pdf file city of mobile.

City of Mobile Alcoholic Beverage Application. Declaration of US Citizenship Letter - Form B. The County sales tax.

Mobile AL 36652-3065 Office. In mobile or our downtown mobile office at 151 government st. Direct Petition for Refund.

I-65 Service Road South Zip 36606 PO. Sales Tax Form 12. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types.

Check here if this is a final tax return. Section 34-22 Provisions of state sales tax statutes applicable to article states. 334-625-2994 Hours 730 am.

In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal. Business License Application. PLUS 2 ON TAX OF 100 IF ANY if submitted prior to.

Sales Tax Form 12. Pelham AL 35124 Telephone. Applicable interest will be assessed beginning February.

Childersburg tax rates for rentals made and lodgings provided within the corporate limits and police jurisdiction of the city. Business License Renewals. The minimum combined 2022 sales tax rate for Mobile Alabama is.

City of Mobile 700. Petition for Release of Penalty. City Ordinance 34-033 passed by the City Council on June 24 2003 went into effect October 1 2003.

While alabamas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. If you are currently setup to Electronically File State of Alabama SalesUse Taxes online step by step instructions for adding Montgomery County to your online filing through the. Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd.

City of Mobile Alcoholic Beverage Application. A homestead exemption may be available to citizens who use their property exclusively as their home. 5 ON 100 OR LESS IN TAX.

The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000. Sales Use Tax Incentives Alabamas sales and use tax laws contain several provisions which give Alabama an advantage over other states. Date _____ Title _____ Signature _____.

DISCOUNT IF PAID ON TIME. Please print out the forms complete and mail them to. Business License Application.

The Alabama sales and use tax law is found in. 30 penalty will be assessed beginning March 1st. This is the total of state county and city sales tax rates.

License Revenue Division 25 Washington Avenue 3rd Floor Montgomery AL 36104 Phone. In Mobile Downtown office is. NOTICE TO PROPERTY OWNERS and OCCUPANTS.

The Alabama sales tax rate is currently. The Revenue Department administers the Privilege License Tax Ordinances of the City of Mobile which involves collection of monthly Sales Use Taxes and licensing. Joint Petition for Refund.

In Mobile or our Downtown Mobile office at 151 Government St. Board of Equalization-Appeals Form. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as.

Drawer 160406 Mobile AL 36616. The alabama sales tax rate is currently. Seller Use Tax Tax Form 13.

Petition for Release of Penalty. Jefferson Shelby MOBILE Bel Air Tower Suite 100 851 E. However pursuant to Section 40-23-7 Code of.

Leasing Tax Form 3. Business entities that file and pay Mobile County Sales Use Lease Automotive Lodging and Mobile County School Sales and Use Taxes should file and. SALES TAX ALCOH.

City of Mobile Business LIcense Overview. Sales and Use taxes have replaced the decades old Gross Receipts tax. Once you register online it takes 3-5 days to receive an account number.

In mobile or our.

Free Global Job Portal For Recruiters And Aspirants Free Job Posting Job Posting Sites Job Hunting

Chicago Now Home To The Nation S Highest Sales Tax Sales Tax Chicago Tax

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Credit Sale Agreement Template Mobile Home Purchase Agreement Form Throughout Credit Sale Agreement Templ Professional Templates Purchase Agreement Templates

Uae There Are No Plans To Introduce Income Tax In 2022 Income Tax How To Plan Income

Coaches Report Template 2 Templates Example Templates Example Report Template Coaching Job Coaching

Bill Of Sale Alabama Real Estate Forms Real Estate Forms Good Essay Letter Sample

Bald Barista Dublin Barista Coffee Art Dublin

Magento Commerce Order Management Coordinates Your Consumer S Experience Across All Sales And Fulfillment Channels Order Management System Magento Optimization

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New York State Sales Tax Login Tax Ny Gov File Online New York State Tax State Tax

Pin 7 The First Cordless Phones Were Introduced To The General Public In 1970s By 1986 Fcc Or The Federal Communications Commi Cordless Phone Phone Cordless

Rustic Acres 608 North Empress Street Mobile Home For Sale In Boise Id 1098574 Mobile Homes For Sale Rustic Mobile Home

Mobile Food Vendor City Of Fort Worth Texas Consumer Health Health Reviews

Be A Part Of World Free Tax Zone Register Your Company Today Business Management Economic Department Services Business

Still Thinking Give Us A Pm And We Ll Help You Think It Through 0 Tax In Business Set Up From 12000usd Full Transparency Dubai Things To Think About Uae